Since 2024, China’s “scrappage-for-renewal” policy has become a key driver in boosting consumer demand and accelerating the transition from petrol cars to new energy vehicles (NEVs). Far from being just another incentive program, this policy is fundamentally rewriting the automotive market’s competition dynamics.

Policy Leverage: A Turbo Boost for NEVs

The scheme’s design is anything but subtle – it heavily favors NEVs over traditional combustion-engine cars. In 2024, a staggering 883.6 million vehicles were replaced through trade-ins, with 211.8 million being NEVs, dwarfing petrol car figures (60.2 million) by a 3.5x margin. Fast forward to early 2025, and the gap has only widened – NEVs accounted for 45.6 million new purchases in Q1 2025, while petrol cars scraped a measly 8.3 million.

Why such a landslide? The numbers don’t lie: NEV subsidies are blatantly more generous. Coupled with purchase tax exemptions, the economic appeal is bloody obvious. By the end of 2024, NEV penetration in the replacement market had breached 50%, and projections for 2025 hover near 55-60%.

Even more telling? About 70% of surveyed consumers admit subsidies sway their buying decisions, particularly in the ¥100-150k price range – where a 5-10% discount is the decider.

Market Upgrade: From Quantity to Quality

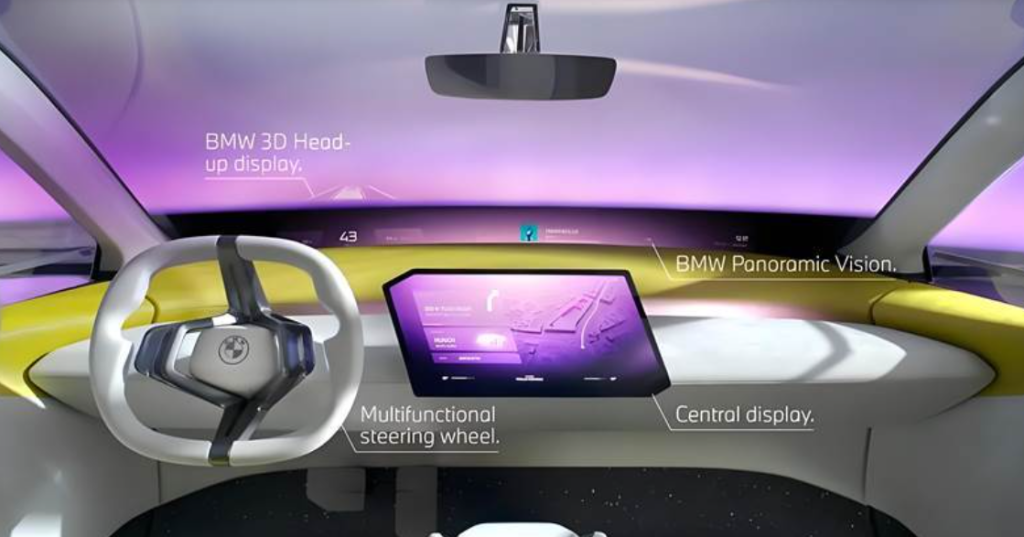

This isn’t just about swapping an old car for a new one, it’s about trading up. Post-policy, B-segment cars (mid-to-high range) now claim over 42% market share, reflecting rising demand for spacious, tech-loaded vehicles. And guess what plays right into this trend? NEVs – with their longer range, superior smart features, and significantly lower running costs. (I have to tell ZingEV readers, now charging at home costs in China only about USD $0.06 per kWh – that’s just six cents, i.e. RMB 0.40 per kilowatt-hour!)

Over half of trade-in buyers now eye ¥200-500k (USD$ 28K+) models, a segment where NEVs (think extended-range SUVs and premium EVs) are rapidly filling the gap. Meanwhile, the petrol car market is being squeezed out of the <¥100k bracket, struggling to remain relevant in a shifting landscape.

Consumer Shift: The NEV Takeover

When 65.3% of trade-in buyers openly prefer NEVs – versus a paltry 17.9% sticking with petrol – you know the tide has turned. Beyond subsidies, the real catalyst is shifting consumer perception:

- Running costs: Charging is cheers to the wallet compared to bloody expensive fuel (I have to say, petrol price is about ONE USD per Liter in China, sucker! Are we forced to use expensive Russia petrol?).

- Tech edge: Seamless OTA updates, next-gen infotainment – modern buyers won’t settle for less.

- Accessibility: Online platforms like Douyin (TikTok China) and Dongchedi (China’s Carwow equivalent) drive 40%+ of policy awareness, streamlining the “claim subsidy → buy car → scrap old model” cycle.

Corporate Battleground: The Rise of Domestic Players

The policy has flipped the script for automakers. BYD and Geely now dominate trade-in sales, with BYD alone clocking 1.44 million swaps in 2024. Compare that to big foreign brands, who are getting absolutely knackered as their petrol-heavy lineups lose appeal.

Tesla and Li Auto (with their long-range models and futuristic cabins) are grabbing chunks of the high-end market, while Japanese and German brands scramble to pivot to EVs – some too late.

The Bigger Picture: An Efficiency Revolution

At its core, this policy isn’t just about incentives – it’s a structured demolition of the ICE market. NEV penetration rate is poised to exceed 55% in 2025, but the real question is: What happens when subsidies fade, say, 2026?

Will NEVs sustain momentum purely on performance and innovation? Or will legacy automakers finally pull their socks up with competitive tech? One thing’s certain: The game has changed, and ICE cars here are on borrowed time.

China Scrappage-for-Renewal Policy https://www.gov.cn/zhengce/zhengceku/202501/content_6997129.htm

Contact the author: jason.huang@bwing.com.cn

![[ETNC REPORT] EUROPE’S STRATEGIC DILEMMA: STUCK BETWEEN UNCLE SAM & THE PANDA](http://www.zingevs.com/wp-content/uploads/2025/07/DM_20250626225244_001-1024x683.jpg)