Looks matter, but there’s more to it. Chinese women are reshaping the logic of car consumption, quietly unlocking a once-overlooked hundred-billion-yuan market.

“The interior of this car is so exquisite – the starlight headliner and ambient lighting make it feel like a moving café.” A post-90s female car owner shared her purchasing experience on Douyin, and the video received over 50,000 likes. On short-video platforms, similar content emerges daily, highlighting an undeniable trend: Chinese women are becoming a significant force in car consumption.

According to a study by a new media platform, the attention around mindset-related keywords associated with women has exploded, with the mention rate of the term “female” increasing by 580% year-on-year. Behind this data lies the beginning of a structural shift in China’s automotive consumption market.

01 The “She Economy” Behind the Numbers: A New Blue Ocean in Car Consumption

The automotive industry has traditionally targeted men, with marketing language centered around power, handling, and engine performance. With the rise of female car buyers, this tradition is being disrupted.

Data shows that female users not only focus on traditional “feminine” features such as exterior color and interior design but are also increasingly interested in technical indicators like intelligent assisted driving and safety performance.

The rise of female car buyers is no accident. The proportion of Chinese women with higher education continues to grow, and the employment rate of urban women exceeds 60%, reflecting strong economic independence. Simultaneously, women’s influence in family car-purchasing decisions is steadily increasing, making them an undeniable consumer force.

02 From Appearance to Experience: A Comprehensive View of Female Car-Buying Preferences

Data analysis from a new media platform reveals distinct characteristics in female users’ car-buying preferences.

Looks matter, but there’s more to it. While female users do pay more attention to exterior design, color choices (especially light shades like white and pink), and interior quality, they also value performance, safety, and smart features.

“Safety” is one of the core concerns for female users, with searches for professional terms such as active safety and C-NCAP crash ratings significantly increasing among them.

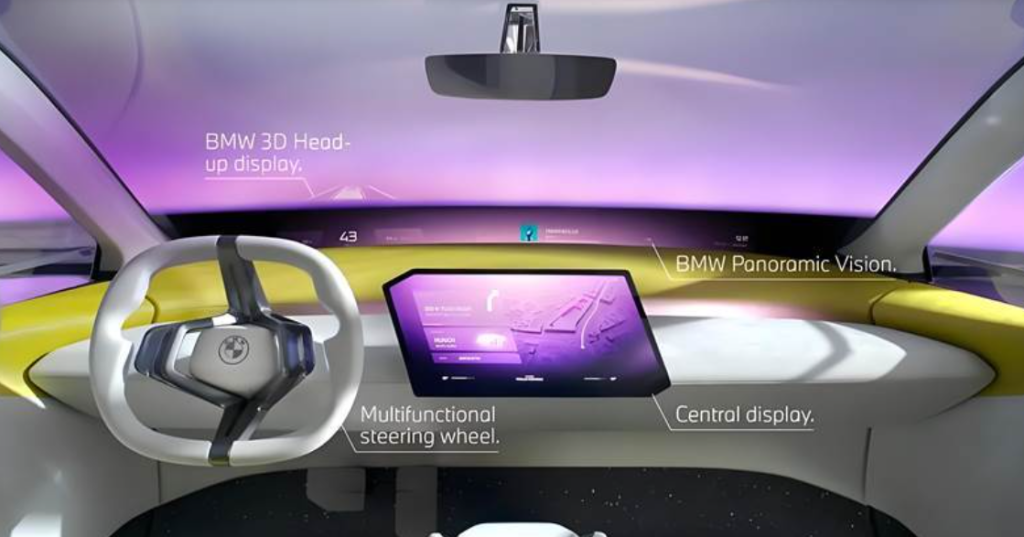

Female users have more detailed requirements for comfort features. Configurations like zero-gravity seats, air suspension, privacy glass, and premium audio systems carry significantly more weight in their purchasing decisions compared to male users.

“This isn’t just about luxury; it’s a redefinition of the car experience,” a car designer commented on this trend. “Female users care more about the overall ambiance and comfort inside the car, which is pushing us to rethink our design philosophy.”

03 Breakthroughs in Niche Markets: Female Preferences Reshaping Product Definitions

The influence of female users is expanding from the sedan market to multiple segments, including SUVs and MPVs.

In the SUV segment, the proportion of female users has risen from less than 25% three years ago to over 36% today. Urban SUVs, with their higher seating position, better visibility, and relatively easy driving experience, have become the top choice for many female users.

Surprisingly, the proportion of female users is also steadily increasing in the traditionally male-dominated off-road SUV market. “Not all female users prefer compact cars; many also appreciate the sense of security and capability that off-road vehicles provide,” said a marketing executive at a domestic off-road brand.

The MPV market is similarly affected. Although the core scenario for MPVs remains business receptions, the proportion of family users is growing, with women often playing a decisive role in family MPV purchasing decisions. Attention to features such as child seat interfaces, in-car air quality, and entertainment systems is largely driven by female users.

04 Marketing Transformation: How to Engage Female Users

The rise of female car buyers is changing automotive brands’ marketing strategies.

Traditional hardcore marketing focused on technical specifications is shifting toward scenario-based and emotional communication. On short-video platforms, content centered around women’s daily car usage scenarios—such as school runs, weekend outings, and gatherings with friends—generates significantly higher engagement rates.

In terms of content format, female users prefer authentic sharing from actual car owners over purely technical explanations. “Female users trust the experiences shared by real car owners more than official manufacturer promotions,” said a content creator in the automotive vertical.

Industry data shows that content with hashtags like “#FemaleCarOwner” and “#HerCarUsage” achieves 120% higher engagement rates than the platform average, reflecting female users’ strong interest and participation in related content.

05 Global Insights from China’s “She Economy”

The evolution of Chinese women’s car-buying preferences offers valuable insights for the global automotive market.

While there are commonalities between female consumers in the East and West, differences also exist. Chinese female consumers show significantly higher acceptance of smart technology, with stronger demand for features like connectivity and intelligent assisted driving.

Chinese women are also more receptive to electric vehicles than their global counterparts. Reports indicate that female users search for keywords like “pure electric” and “range” 35% more frequently than male users, highlighting their greater interest in new energy vehicles.

“These changes in the Chinese market offer lessons for global automakers,” said a marketing head of a multinational automotive brand in China. “The rise of female users isn’t unique to China, but the speed and scale of this trend in China are indeed surprising.”

Chinese automotive brands have demonstrated greater agility in responding to female preferences. Several popular models have quickly launched special editions tailored to female users, offering not only more color choices but also adding features like massage seats and fragrance systems that appeal to women.

The global automotive industry faces pressure from homogenized competition, and differentiators often lie in unmet needs.

The evolution of Chinese women’s car-buying preferences sends a clear signal: automotive consumption is shifting from performance-driven to experience-driven. This is a critical insight for all market players—those who better understand and meet the needs of female users will gain a competitive edge in the next phase.

Female users don’t want pink versions of cars; they want products that truly meet their needs. The “She Economy” isn’t about minor adjustments to niche markets but a fundamental restructuring of automotive consumption logic.

06 Two Cars Popular Among Chinese Women

- Xiaomi SU7: The Perfect Fusion of Technology and Aesthetics

As a best-selling coupe in the 300,000-yuan range, the Xiaomi SU7 precisely meets women’s demand for “both looks and experience.” Its streamlined body features frameless doors (a luxury brand keyword with an 18% growth rate) and offers custom colors like pink and purple, visually overturning traditional sedan stereotypes. More importantly, its scenario-based tech features include a smooth central control screen interaction (the keyword “smooth” grew 536% on Douyin) supporting voice control and a makeup mode. Standard zero-gravity seats (360% growth rate) and a multi-mode fragrance system transform the cabin into a mobile living space. A Shanghai finance professional shared on social media: “My daily commute has become a delight! The seat massage relieves overtime fatigue, the fragrance changes with my mood, and even the vanity mirror has soft lighting—it understands the sense of ceremony women want.” - Wuling Bingo: A Warm Expression of Practicality

In the 100,000-yuan market, the Wuling Bingo has become the top choice for women’s first car purchase with its “compact size + high emotional value.” Its compact dimensions and simple reverse camera ease urban parking anxiety, while the sunken trunk (203% growth rate) easily accommodates strollers or camping gear. Rounded interior lines and cream-colored tones create a cozy atmosphere. Under Douyin’s #HerCarUsage topic, a mother from a 3rd-tier city shared: “It handles school runs and weekend camping effortlessly! The trunk fits a tent and coffee machine, the rounded interior feels like touching clouds, and maintaining it costs no pressure on a monthly salary of 8,000 yuan.” With an electricity cost of 0.05 yuan per kilometer, it aligns perfectly with the “life smart spender” mindset.

Contact the author: nietao23@163.com