From 2023 to 2026, China’s automotive market will witness an unprecedented conflict – the “Battle for Existing Customers.” As the “peak users” from 2016 to 2018 enter a large-scale replacement phase, competition for the existing customer market has intensified.

According to the 2023 Brand Loyalty Report by Yiche Research Institute, brand loyalty in China’s passenger vehicle market exceeded 20% for the first time, reaching 21.46%. However, the long-standing dominance of premium foreign brands is being overturned by Chinese automakers such as BYD and Li Auto, indicating an inevitable industry reshuffle.

1. Rising Loyalty, Intensifying Competition

Over the past two decades, China’s market was dominated by first-time buyers. Since 2020, however, brand loyalty has surged from 17.09% to 21.46% (as of 2022). This trend highlights the strategic value of existing customers – they are not only the backbone of sales but also crucial for low-cost customer acquisition and brand advocacy.

Loyalty distribution remains uneven. Traditional giants like Audi, Mercedes-Benz, and BMW are losing ground: in 2022, the loyalty rate of premium foreign brands dropped to 21.83%, surpassed by mass-market foreign brands (22.81%) and closely trailed by Chinese brands (20.40%). This shift is driven by products such as the Li Auto L9 and BYD Han, which cater to family-oriented and energy-efficient demands, while legacy brands cling to outdated strategies.

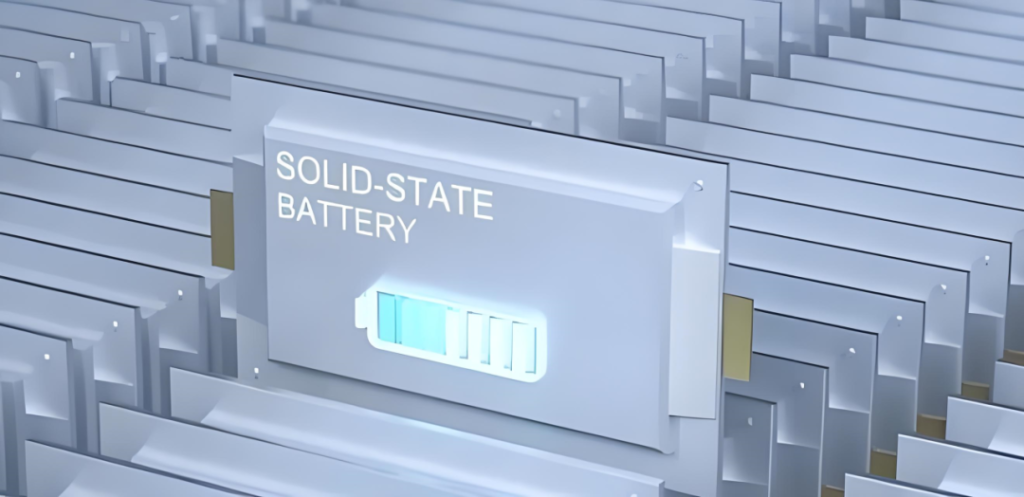

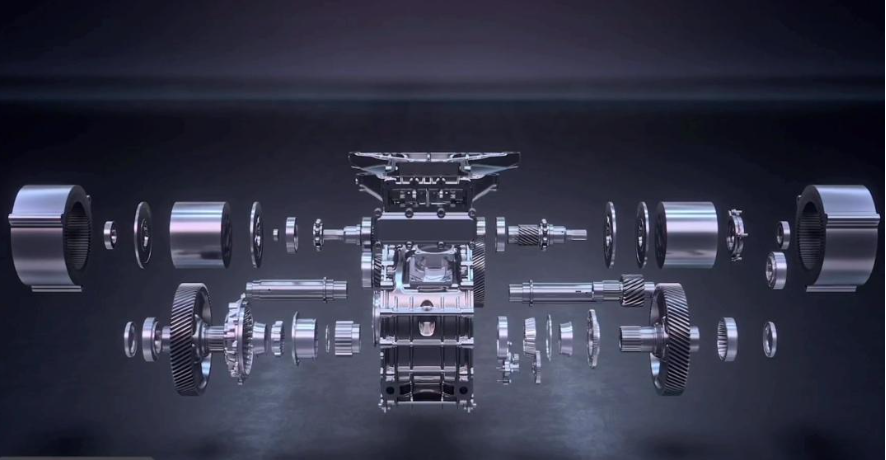

2. Chinese Brands’ Ascent: Dual Drivers of Premiumization and Electrification

In 2022, BYD topped the loyalty ranking at 39.32%, followed by NIO (34.03%) and Toyota (33.52%). BYD’s success is no accident: over 80% of its sales come from models priced above USD 18,000, paired with a balanced portfolio of plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) that align with evolving consumer needs.

In contrast, Haval and Geely lag in premiumization and electrification. Haval’s lineup remains 98% focused on models below USD 25,000 and heavily reliant on ICEs; Geely, despite a temporary boost from the Xingyue L, remains trapped in the compact ICE segment. Brands without a clear roadmap risk rapid customer attrition.

3. Foreign Brands’ Predicament: Adapt or Perish

Mass-market foreign brands face the gravest crisis. Their annual sales plummeted from 12 million to 8 million units between 2017 and 2022. While Volkswagen’s SUV strategy maintains a 26.71% loyalty rate, its heavy reliance on ICEs (over 90% of sales) leaves it vulnerable to rivals like BYD. Nissan, with 50% of sales from models below USD 17,000, is caught in a downward spiral.

Toyota stands as an exception, leveraging hybrid electric vehicles (HEVs) and premium models (e.g., Highlander, Sienna) to sustain a 33.52% loyalty rate. Yet its HEV-heavy approach may clash with China’s tightening NEV credit policies.

4. The 2026 Showdown: Who Will Prevail?

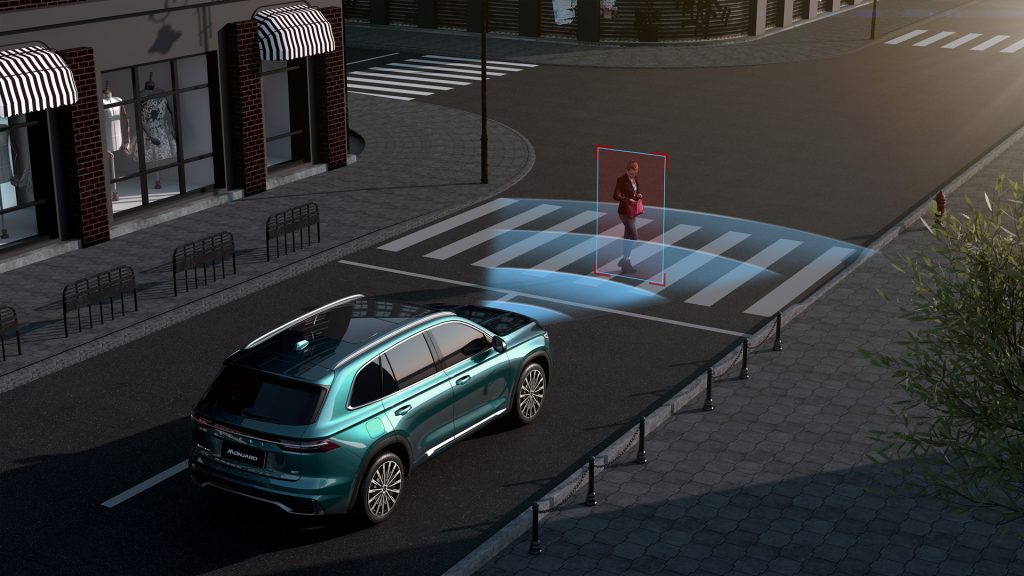

The future automotive battleground is shifting: premiumization, family-centric design, electrification, personalization, and city mobility – these ‘New Five Trends’ are redefining industry benchmarks, moving beyond traditional metrics like horsepower and fuel efficiency. Chinese brands like BYD and NIO are leading this transition through multi-brand strategies, while premium foreign brands must accelerate their adaptation to China’s unique mobility ecosystem.

Conclusion

This “final battle” represents a transformative opportunity for Chinese brands, a survival test for mass-market foreign players, and a wake-up call for premium marques. In the end, only those who truly understand local consumers will emerge victorious.

Source: 2023 Brand Loyalty Report by Yiche Research Institute

-The data is sourced from Yiche certified car owners, with a sample size exceeding one million in 2022.

-Loyalty = The ratio of repeat purchases within the same brand to total purchases by the brand’s verified owners in a given year

-Brand Selection Criteria: Sales volume: Minimum 50,000 China retail sales in 2022.

Contact us for the free Chinese PDF version of the report.

![[POLICY WATCH] CHINA’S 2025 CAR SCRAPPAGE SCHEME: HOW NEVS ARE RESHAPING THE MARKET](http://www.zingevs.com/wp-content/uploads/2025/07/388ec94d-e2cc-4894-97e0-48762c7e4d1d-1024x615.jpg)

![[ETNC REPORT] EUROPE’S STRATEGIC DILEMMA: STUCK BETWEEN UNCLE SAM & THE PANDA](http://www.zingevs.com/wp-content/uploads/2025/07/DM_20250626225244_001-1024x683.jpg)