Speaking at the 2019 Beijing CPCA Forum

When it comes to the automotive aftermarket, some describe it as a “jungle”—chaotic, loosely regulated, yet full of hidden gold. In this vast ecosystem of 420,000 repair shops, you’ll find everything from luxurious 4S dealerships to small family-run garages tucked away in alleyways, along with fast-growing internet-based chains. But all players face the same question: How do they carve out a winning path in this cutthroat competition?

A Market in Chaos

A widely circulated joke in the auto parts world goes like this: The same brake pads can be called “OEM parts” at a 4S shop, “branded parts” or “equivalent parts” in the wholesale market, or even end up as dubious “gray market parts.” Behind these confusing labels lies the unique complexity of the local aftermarket supply chain – where a single component can change hands up to 10 times before reaching the car owner.

This inefficient distribution model has long sustained a vast network of middlemen. But now, internet-driven supply chain platforms backed by Alibaba’s investments are disrupting the status quo, vowing to “slash parts prices.” Their strategy is straightforward: Use data to match supply and demand, leverage logistics for direct-to-shop deliveries, and provide financing solutions to ease cash flow constraints. The results speak for themselves—one tire brand saw its supply chain costs drop by 17% in a pilot program.

The Double-Edged Sword for Dealership (Being called 4S Shops in China)

On the surface, 4S dealerships still dominate the market, holding a 63% revenue share with after-sale service margins often exceeding 50%. But look closer, and you’ll find deep anxiety brewing.

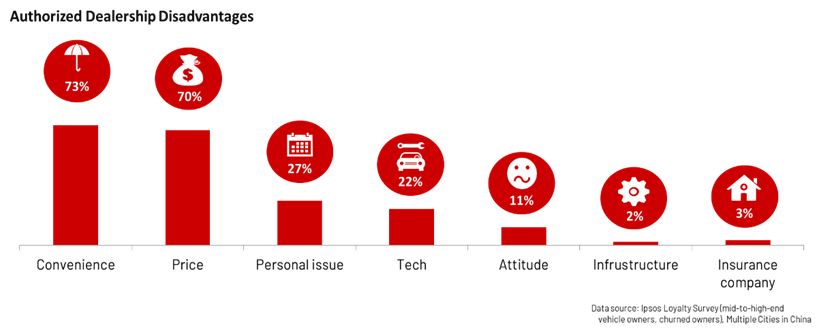

The most painful issue? Customer churn. Data shows that once a car’s warranty expires, only 36% of owners return to 4S shops for maintenance. The reasons are familiar: sky-high prices, slow service times, and inconvenient locations. One luxury brand dealership calculated that while warranty-covered vehicles visit an average of 2.3 times per year, post-warranty retention plummets to just 0.8 visits—a textbook case of “out of sight, out of mind.”

To turn the tide, dealerships are getting creative. Some are revamping waiting areas into café-style lounges to enhance customer comfort. Others offer “lifetime free maintenance” plans, cleverly tying them to lucrative insurance and extended warranty deals. One Shanghai-based group even launched a chain of “neighborhood quick-service shops” catering specifically to post-warranty vehicles at half the cost of 4S services. The results vary, but one thing is clear: The days of passively waiting for customers are over.

The Key Battlegrounds for Survival

As competition intensifies, success will hinge on excelling in three key dimensions:

1. Mastering High-Frequency Touchpoints

In Hangzhou, a new business model called “quick oil-change stations” is gaining traction. Owners can book a 5-minute oil change via smartphone at 40% lower cost than a 4S shop. This approach reframes maintenance from a cumbersome chore into something as routine as a car wash—locking in repeat customers.

2. Reinventing the Service Experience

NIO has set an example by transforming its service centers into car owner hubs. Weekend family events and meetups organically increase foot traffic, creating stickiness beyond mere repairs. One joint-venture brand took notice and redesigned its service lounge as a “book nook,” subsequently doubling paint-and-body repair bookings.

3. Innovating with Financial Models

Mercedes-Benz’s German “Flexperience” program provides valuable insights: Customers pay a fixed monthly fee for bundled insurance, maintenance, and even car-swapping services—effectively shifting from a purchase model to a subscription model. Some Chinese dealerships are experimenting with similar schemes, packaging maintenance plans as “service securities” to lock in long-term customer value.

Final Thoughts

The aftermarket shakeout is far from over, but the rules of the game have fundamentally changed. The old model—relying on parts markups—is fading fast, replaced by battles over service experience and customer engagement. The survivors won’t necessarily be the most technically advanced, but those who best transform impersonal repair tickets into meaningful customer interactions.

“Customers don’t care about the signboard,they care about the person who solves their problem.” That, perhaps, is this industry’s simplest yet most profound truth.

Written by Sheng Y, aka Sparky McSparkFace, China Auto Industry Researcher

- 20 yrs Experience – Consulting/research/local car sales and spare parts trading, ex-CPCA(China Passenger Car Association) insider

- Research Director – Expert in market/consumer studies, product strategy, dealer networks

- Bilingual (EN/CN) – Int’l education, cross-cultural savvy

Let’s Zing into EV insights: sheng.ye@ipsos.com

![[POLICY WATCH] CHINA’S 2025 CAR SCRAPPAGE SCHEME: HOW NEVS ARE RESHAPING THE MARKET](http://www.zingevs.com/wp-content/uploads/2025/07/388ec94d-e2cc-4894-97e0-48762c7e4d1d-1024x615.jpg)