1. Record Sales and Market Share: Hybrid Technology Emerges as Core Growth Driver

According to CPCA export data, Chinese auto brands exported 111,000 vehicles to Europe in June 2025, a 118% year-on-year increase. In the first half of 2025, exports reached 601,000 units, up 33% YoY. Chinese passenger vehicles now hold a 4.9% market share in Europe (+1.8 percentage points YoY), setting a historic high. This breakthrough stems from three transformative factors—technological innovation, cost revolution, and strategic upgrades—whose impact transcends short-term sales and is reshaping Europe’s automotive competition rules.

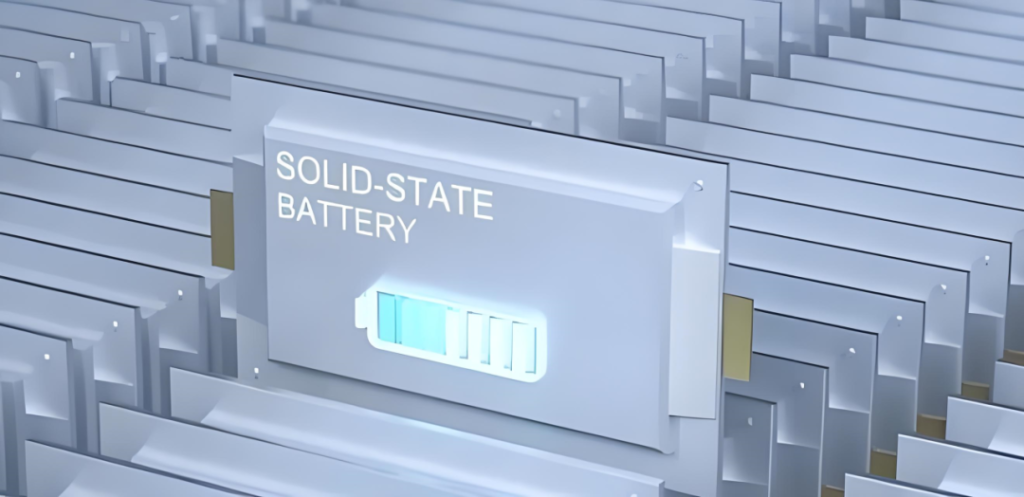

The growth exhibits distinct technological trends. Data from January-May 2025 reveals that plug-in hybrids (PHEVs) and hybrids (HEVs) jointly contributed 74% of the market share growth. PHEVs saw their share surge by 7.2 percentage points YoY to 9.4%, far outpacing the 2.2-point gain of pure EVs (BEVs). This divergence reflects strong European demand for “range-anxiety-free electrification” solutions.

At its core, hybrid success lies in precise product-market fit. Europe’s charging infrastructure lags behind electrification targets, with public charger density at just 30% of China’s major cities. Against this backdrop, BYD’s DM-i and other series-parallel hybrid systems—offering 100+ km pure EV range for daily commutes while retaining fuel flexibility—have become the optimal solution.

2. Five Drivers Behind the 2025 Hybrid Sales Surge

① Tariff Divergence Triggers Strategic Shifts

Since October 2024, the EU has imposed anti-subsidy duties as high as 45.3% on Chinese BEVs (on top of a 10% base tariff), while PHEVs face only the 10% base rate. This gap has pushed Chinese automakers to pivot exports toward PHEVs, sustaining price competitiveness and serving as a short-term lever to unlock the European market.

② Generational Tech Gaps Deliver Product Supremacy

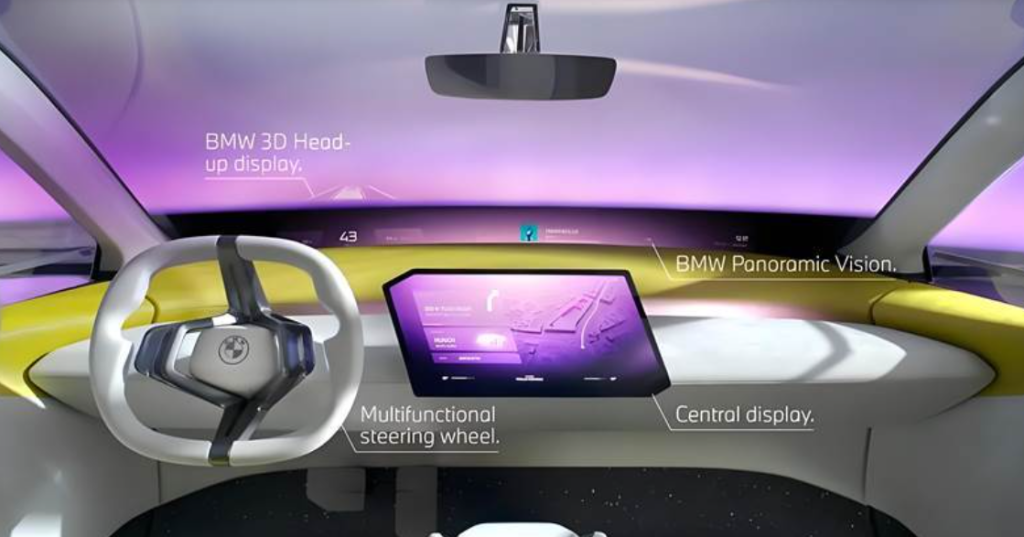

Chinese hybrids outperform European and Japanese rivals with “electric-first” architectures. BYD DM-i and Geely’s Thor Hi·P systems offer 100–200 km WLTP BEV range – doubling European models’ 50–70 km – directly addressing charging scarcity (Europe’s vehicle-to-charger ratio trails China’s). The DM-i 5.0 platform achieves 46.5% thermal efficiency (vs. Europe’s 40%–42%) and 0.8L/100km fuel consumption. Smart features like terrain-adaptive energy management and voice-controlled parking further attract younger buyers.

③ Cost-Performance Edge Fuels Market Penetration

Chinese PHEVs leverage domestic supply chains to deploy “more features for less” strategies. As of 2025, their hybrid powertrains cost 28% less than Europe’s, enabling price tags of €35,000–45,000, 15%–20% below European competitors (€42,000–55,000).

④ Filling Europe’s Supply-Demand Mismatch

European automakers’ overfocus on BEVs left hybrids underdeveloped, yet consumers favor PHEVs due to charging anxiety (Europe’s worse infrastructure) and fading subsidies. With 50-km average commutes, Europe’s short-range PHEVs struggle to meet needs. Meanwhile, EU CO2 targets (55% cut by 2030) pressure OEMs to promote low-emission vehicles—Chinese PHEVs emit 50% less than ICE cars and avoid 2035 BEV-only policy uncertainties.

⑤ Localization and Premium Branding Break Barriers

Chinese firms mitigate long-term risks via local production and rebranding. BYD’s Hungary plant (2026) and Chery’s Spain JV (producing EBRO models) enable tariff-free EU assembly. MG sponsors Liverpool FC; Lynk & Co sheds “budget” labels with premium positioning. Service networks expand—one brand plans 1,000 European outlets in 3 years; Leapmotor leverages Stellantis’ Poland plant to slash aftersales costs.

3. The Broader Context: China-Europe Auto Dynamics

Europe’s century-old automotive heritage- exemplified by Porsche/BMW’s chassis tuning and passive safety leadership (+15% patents vs. industry average) – remains unmatched. Post-Audi Brussels factory closures, Chinese brands absorbed engineers to co-develop intelligent chassis algorithms for European roads, forging a “European precision + Chinese electrification” symbiosis.

Deeper collaboration thrives in electrification and AI. ZF Group’s “Chassis 2.0” merges German tuning with Chinese e-drive tech for Alpine winter roads; Junshe Intelligent partners with BMW Austria to deploy flexible production lines (50-sec/e-drive unit output), while VW’s €400M investment in XPeng’s EE architecture includes MQB platform sharing- a two-way tech exchange.

This complementarity is accelerating: as “China speed” meets “European quality,” the co-innovation is scripting not just industrial upgrades, but a sustainable, win-win future. Chinese efficiency lifts European output, while European standards refine Chinese quality. It’s not always romantic- cultural clashes and IP disputes persist – but facing the 2050 carbon neutrality countdown, this may be the East-West industrial handshake we need.

Contact the author: nietao23@163.com

![[POLICY WATCH] CHINA’S 2025 CAR SCRAPPAGE SCHEME: HOW NEVS ARE RESHAPING THE MARKET](http://www.zingevs.com/wp-content/uploads/2025/07/388ec94d-e2cc-4894-97e0-48762c7e4d1d-1024x615.jpg)

![[CONSUMER INSIGHTS] WHAT SHOULD CHINA LUX. NEVS LOOK LIKE?](http://www.zingevs.com/wp-content/uploads/2025/07/DM_20250705201845_001-1024x514.jpeg)

![[ETNC REPORT] EUROPE’S STRATEGIC DILEMMA: STUCK BETWEEN UNCLE SAM & THE PANDA](http://www.zingevs.com/wp-content/uploads/2025/07/DM_20250626225244_001-1024x683.jpg)